Anyone who invests in real estate in Tuscany sooner or later always asks themselves the same question: Are short-term or long-term rentals better?

The answer that no one likes is this: It depends on the property, the area and how much you are willing to manage. Those who promise universal solutions usually don't manage anything themselves.

In Tuscany, the issue is even more delicate, because tourism is booming but regulations are becoming increasingly selective. Making the right choice today means looking beyond gross profit and thinking in terms of net return, risk and sustainability over time.

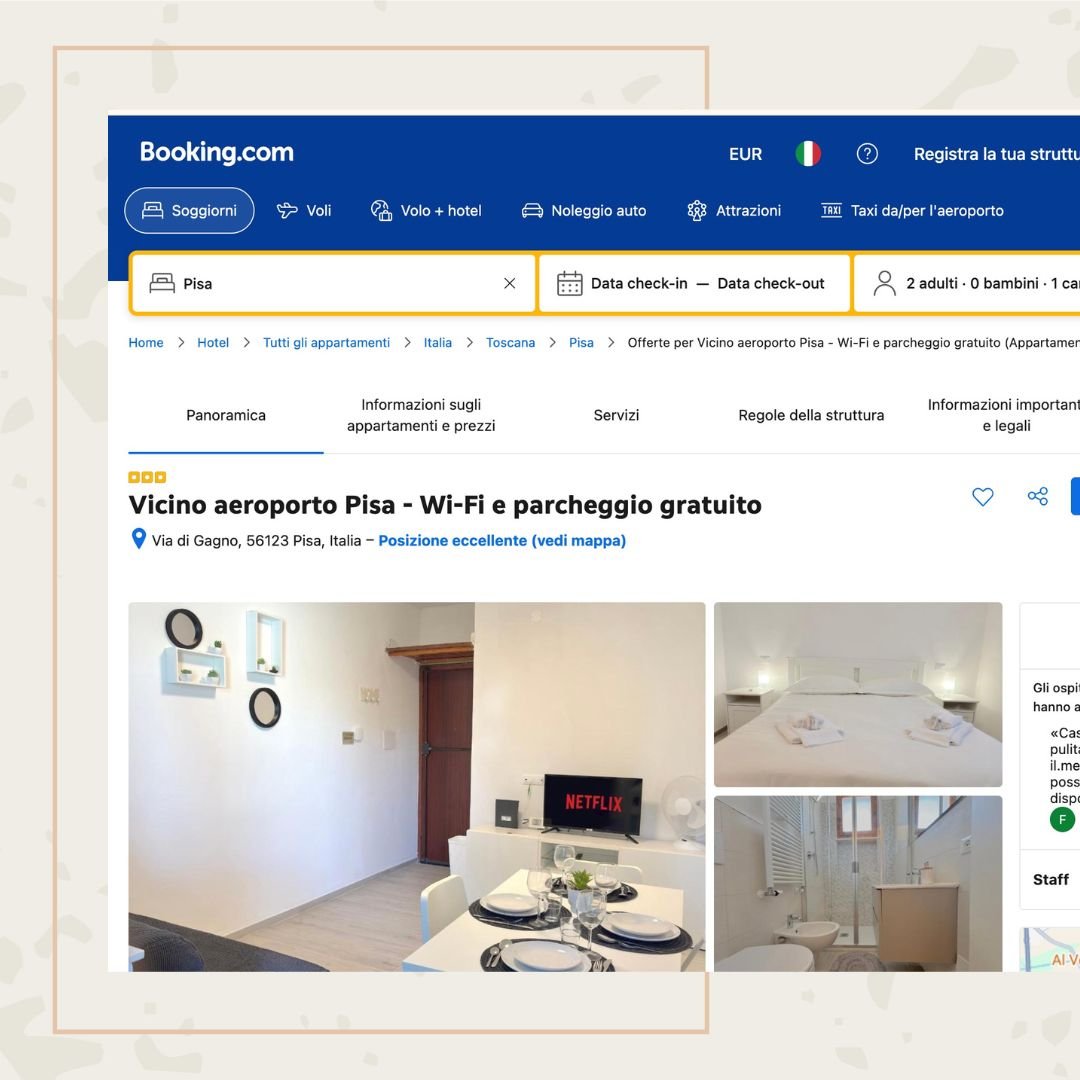

In cities with high tourist appeal such as Florence, Pisa, and Lucca, short-term rentals continue to be very attractive. Average daily rates range between 120 and 160 euros per night, and with an occupancy rate of around 70%, a well-located property can generate gross earnings between 23,000 and 30,000 euros per year.

The main advantage is obvious:

On paper, it seems like the perfect choice. In practice, the story is more complex.

The management of short-term rentals is intensive, It's not a passive investment. Frequent cleaning, check-ins, maintenance, platform fees, and tax management significantly reduce your margin.

In many cases, at the end of the year, the real net yield it settles around the 2–3%, very close to that of long-term rentals.

Furthermore, since 2025 the regulatory framework in Tuscany has become more stringent:

Moral: short-term rentals work only if it is managed professionally. Improvising today is the fastest way to reduce margins and increase risks.

Long-term rentals remain a solid solution, especially in residential areas, away from the hottest tourist circuits. A stable rent, for example, 900 euros per month, ensures predictability and much easier management.

The main advantages:

For many investors, this is a less stressful option, especially if they don't want to deal with management directly.

On the other hand, long-term rental offers:

In Tuscany, where tourism demand is strong, long-term rentals often fail to fully exploit the property's economic potential, especially in art cities.

Comparing the two options:

The best choice is not “short or long”. It is the one consistent with your property and your investor profile.

An apartment in Florence's historic center has completely different logic than a property in a provincial residential area. Treating everything the same is the most common mistake we see.

Eweka was created precisely to avoid these wrong choices.

We don't necessarily push short-term or long-term rentals. We analyze:

Only then do we build a coherent, sustainable management strategy oriented towards real, not theoretical, returns.

In Tuscany, today more than ever, It's not the one who earns more on paper that wins, but the one who manages it better over time..

And that's where structured consultancy makes the difference.

We have much more in store for you. Join us now.

Suzy Queue 4455 Landing Lange, England, 40018-1234